Nor does QuickBooks have features like built-in tenant screening.įinally, since QuickBooks is not targeted toward landlords, the support documentation and articles don’t provide industry-specific tips and there are limited educational materials to help you utilize the platform to grow your portfolio. In addition, it doesn’t have the functionality to send templated emails to tenants or automate rent reminders.

For example, although it facilitates invoice payments, it doesn’t have a tenant portal to allow your tenants to view historical and upcoming payments or set up automated online rent payments. The second major limitation is that QuickBooks doesn’t have industry-specific features.

As QuickBooks isn’t designed with landlords in mind, you need an even better understanding of the program before it will start saving you time.

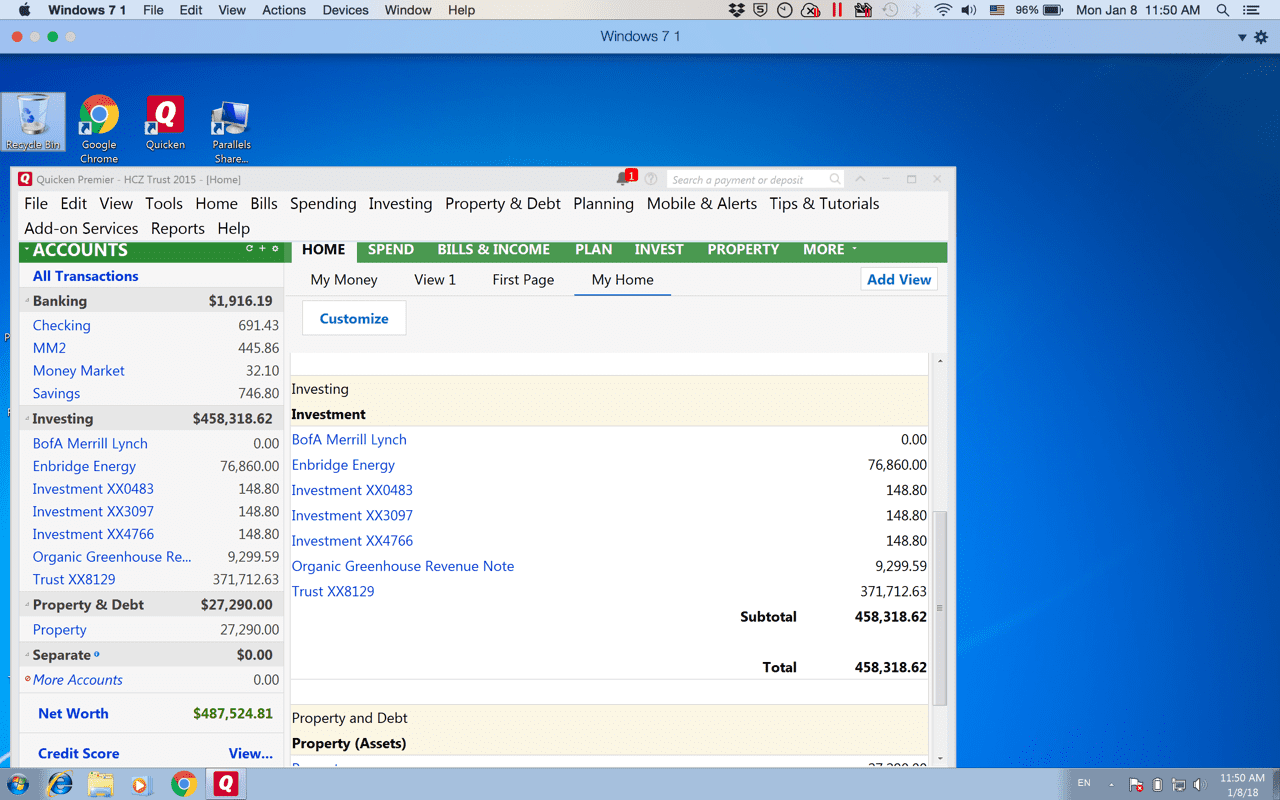

Quicken rental management for mac software#

There’s always a learning curve when adopting new software but this can be particularly difficult when the software isn’t designed exactly for your purpose. The first limitation of using QuickBooks for a rental property is that it’s difficult to set up everything correctly. In contrast, property management software like Landlord Studio has industry-specific features that are specifically designed to make rental property management easier. The Limitations of Using QuickBooks for a Rental PropertyĪlthough it is the leading accounting software for small businesses, there are some limitations to using QuickBooks for real estate, particularly for managing rentals. It’s worth exploring some tutorials on Youtube that can walk you through the setup process. If you have rent from more than one tenant, select “ Group with other undeposited funds” to move on to the next cash receipt entry. If you are inputting rent for one tenant only, click “OK” to save the receipt.

However, QuickBooks is primarily designed for small to midsize businesses.

0 kommentar(er)

0 kommentar(er)